p/s again, kwailow bullish going into 4Q

Want to trade futures? Looking for Guidance|Dealing 03 21660189|Support 03 21636288|kan_@hotmail.com|

Fbm weakness continues to drag the mkt. But still consider a pullback in an uptrend mkt. Waiting for the right time to long while no sell plan if mkt trades above the green line support.

Fbm weakness continues to drag the mkt. But still consider a pullback in an uptrend mkt. Waiting for the right time to long while no sell plan if mkt trades above the green line support.

Fbm produced another lackluster day, barely ending a 4-day losing streak despite strong regional tone. While no fresh negative signal, the mkt failed to take to the upside above 1210. Like yesterday, dragging Fkli along.

Fbm produced another lackluster day, barely ending a 4-day losing streak despite strong regional tone. While no fresh negative signal, the mkt failed to take to the upside above 1210. Like yesterday, dragging Fkli along.

Unfortunately, follow through fails to prevail amid bearish external factors. The wait for bounce only translate to ‘give up selling” as the wait for fbm to bounce remains a wait.

Unfortunately, follow through fails to prevail amid bearish external factors. The wait for bounce only translate to ‘give up selling” as the wait for fbm to bounce remains a wait.

Regional negative, led by HS that played up worries over “potential higher interest rate “ after Fed OKed to the US economy performance, providing a keen-jerk reaction or excuse to sell. While still to early to fear higher R%, pressure remains amid weaker DJ, meaning no clear mkt moving news at mom just a lot of noise.

Regional negative, led by HS that played up worries over “potential higher interest rate “ after Fed OKed to the US economy performance, providing a keen-jerk reaction or excuse to sell. While still to early to fear higher R%, pressure remains amid weaker DJ, meaning no clear mkt moving news at mom just a lot of noise.

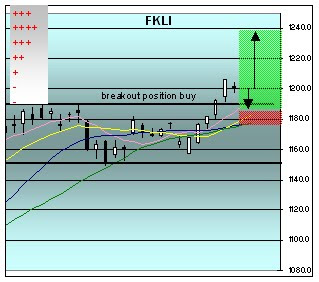

While 1240 may seem too high today, but such a pullback is very damaging. fbm's chart is bery-toppish while fkli still OK...neutral from the previous day and keeping its upside hope alive. But fbm must first trade above 1220. Otherwise, defensive play. Trading sell below 15. Fresh buy above 25 if fbm not to0 far back. 20-25 dont bother!

While 1240 may seem too high today, but such a pullback is very damaging. fbm's chart is bery-toppish while fkli still OK...neutral from the previous day and keeping its upside hope alive. But fbm must first trade above 1220. Otherwise, defensive play. Trading sell below 15. Fresh buy above 25 if fbm not to0 far back. 20-25 dont bother!

After pausing for most of the day, Fbm closed at year-high on buying after 4.30 pm This help fkli to recapture 1220 lvl but activities were slow. Second lowest daily turnover this year.

After pausing for most of the day, Fbm closed at year-high on buying after 4.30 pm This help fkli to recapture 1220 lvl but activities were slow. Second lowest daily turnover this year.

Mkt was strong but could have been stronger especially in PM as regional extends gains in PM on banking sector. Activities very slow. …Raya mood already! Fbm rather reluctant.

Mkt was strong but could have been stronger especially in PM as regional extends gains in PM on banking sector. Activities very slow. …Raya mood already! Fbm rather reluctant.

Very quiet, daily lowest vol yet this year. The mkt stagnant at high side but failed to make fresh upside impression, meaning continues to struggle near 1210. Regional was mixed at best.

Very quiet, daily lowest vol yet this year. The mkt stagnant at high side but failed to make fresh upside impression, meaning continues to struggle near 1210. Regional was mixed at best.

The mkt basically price-in DJ’s expected losses tonight, following strong indication from DJ futs. Despite weaker regional and Europe mkts, fkli maintained its ground above 7SMA, helped by fbm’s resilience. Early attempts to scale 1210++ failed to sustain as no recovery from the regional side.

The mkt basically price-in DJ’s expected losses tonight, following strong indication from DJ futs. Despite weaker regional and Europe mkts, fkli maintained its ground above 7SMA, helped by fbm’s resilience. Early attempts to scale 1210++ failed to sustain as no recovery from the regional side.

A day of profit take for most mkts. A quiet day especially PM session. But price remained in positive zone. Despite strong start. Fbm succumbed to peers pressure. But fkli was surpising ly resilient and remained upbeat near 1200.

A day of profit take for most mkts. A quiet day especially PM session. But price remained in positive zone. Despite strong start. Fbm succumbed to peers pressure. But fkli was surpising ly resilient and remained upbeat near 1200.

Europe helped to reverse regional sluggishness. Main driving force is HS. See tweet.

Europe helped to reverse regional sluggishness. Main driving force is HS. See tweet.

Mkts was mostly resilient on a day that upside potential seemed next to zero. After early selling on DJ effect, fbm crawled back above 70. But, fkli attempts to close the gap was disrupted by weaker Europe and DJ futs after 4.00 pm.

Mkts was mostly resilient on a day that upside potential seemed next to zero. After early selling on DJ effect, fbm crawled back above 70. But, fkli attempts to close the gap was disrupted by weaker Europe and DJ futs after 4.00 pm.

In Aug, Asian equities mostly lower on China’s effect. China slumped more than 20% on liquidity concerns. But, DJ edged higher following strong housing data.

In Aug, Asian equities mostly lower on China’s effect. China slumped more than 20% on liquidity concerns. But, DJ edged higher following strong housing data.