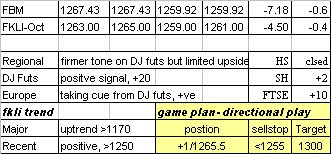

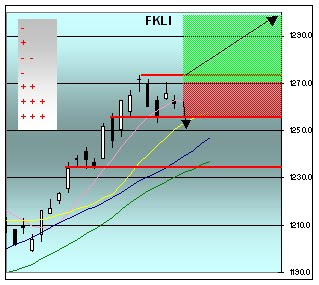

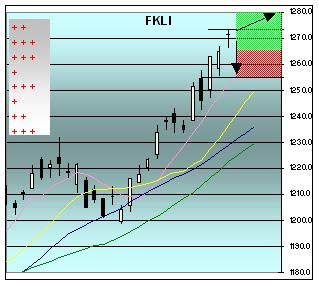

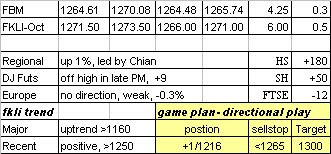

Mkt finished near lows as "sell on rebound" mode prevented the mkt from sustaining its early big gains. The mkt is now fishing for direction and this may take a long time. Range trading for Nov 1250-1270. if bulls are lucky.

Next week, below 1230 is a strong sell call. As for upside, the mkt must at least take out 55 to dispell "some' of this week's bad vibes.