FCPO prices rose +57% in 2009.

FCPO prices rose +57% in 2009.

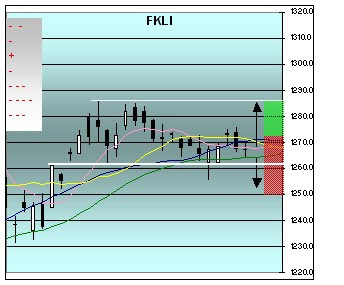

Trading: Opportunities Are Dispersed

-

Opportunities are dispersed. You might have an... *READ THE REST OF THE

ARTICLE ON THE NEW WEBSITE: JIM ROGERS TALKS MARKETS *

*Jim Rogers is a legendary i...

3 years ago