DJ +30, on strong economic data. Retail and auto sales rose. European mkts finished 0.5 to 1% higher.

8.10 : DJ futs +1 Nk +89. Kos +10

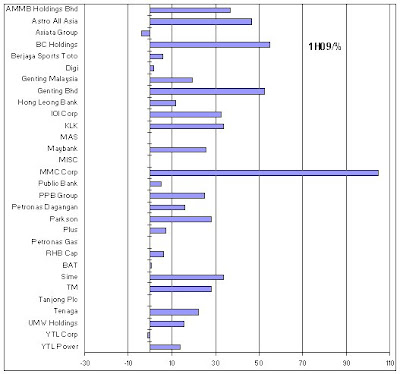

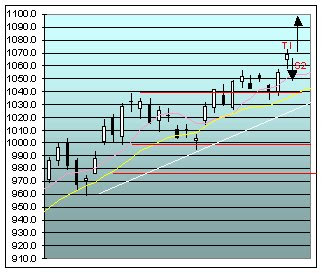

I can smell 1100 already!! too optimistic? maybe yes on a closing basis...but not suprise if any big moves towards this resistance on intra-basis. At +0.5%, our mkt is seen at 1095++.

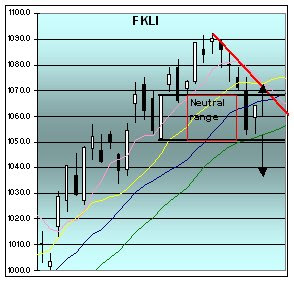

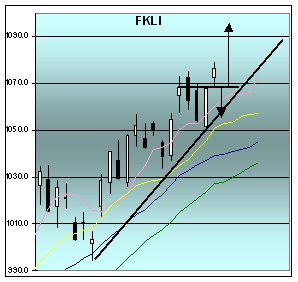

As far as FKLi is concerned, 1080 looks good as a support today, expecting a firm if not bullish mkt. But below 1088.5 is still chart negative tone. Will have to rely on Klci strength to push it above 1090.

Focus on buy unless you think the mkt will close below the 2-mth old uptrend line. Selling at higher end is for intra-day play. Technically, overnight short position is only favorable if Jun closes below 1080.