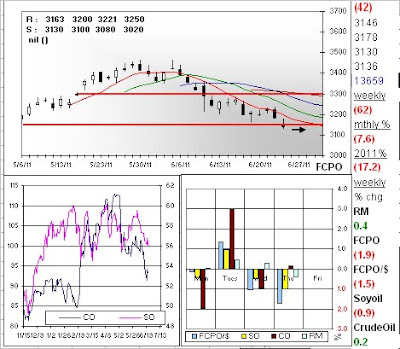

Fcpo fails to cross above 7SMA resistance and instead does a reversal under 3100 again in late PM trades.

No major fresh sell signal yet but bears seen taking charge tomorrow. 3000-3100 range or keeping mkt within a descending triangle formation.

Under 3000 in July is likely to spark fresh leg dw towards 2850+.