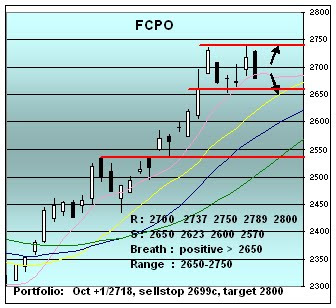

Intra-day looks a bit toppish but bargains seen at lower end. Matching SO gains, Fcpo stays range bound at higher end, getting ready for a test at 2600 after MERDEKA break.

Intra-day looks a bit toppish but bargains seen at lower end. Matching SO gains, Fcpo stays range bound at higher end, getting ready for a test at 2600 after MERDEKA break. Want to trade futures? Looking for Guidance|Dealing 03 21660189|Support 03 21636288|kan_@hotmail.com|

Fcpo holding above 2500 after a selling from 2750 lvl. It finished the week on rebound mode and looks like a sideways and consolidation band , 2500-2600, next week.

Fcpo holding above 2500 after a selling from 2750 lvl. It finished the week on rebound mode and looks like a sideways and consolidation band , 2500-2600, next week.

Fbm.fkli finished on strong note on SIME gains, capping a strong week on good earnings report. DJ weaker tone failed to dampen mkt mood with Europe/regional mostly mixed for the week.

Fbm.fkli finished on strong note on SIME gains, capping a strong week on good earnings report. DJ weaker tone failed to dampen mkt mood with Europe/regional mostly mixed for the week.

Like fkli, fcpo also rebounded sharply in PM, after a steady AM session , encouraged by SO gains for 2 consecutive days and tech buy above 2500. Fcpo crossed above 2500 shortly after PM opening bell. It triggered late buying activities that pushed fcpo to finish at day's high.

Like fkli, fcpo also rebounded sharply in PM, after a steady AM session , encouraged by SO gains for 2 consecutive days and tech buy above 2500. Fcpo crossed above 2500 shortly after PM opening bell. It triggered late buying activities that pushed fcpo to finish at day's high.

Super Fbm, managing to maintain its winning streak to 8 despite poor external factors in PM. Europe -1% DJ futs -80. GENTING , AXIATA took control in PM. Fkli watching from a distance , taking discount stance and like yesterday mostly in and out 1400 lvl.

Super Fbm, managing to maintain its winning streak to 8 despite poor external factors in PM. Europe -1% DJ futs -80. GENTING , AXIATA took control in PM. Fkli watching from a distance , taking discount stance and like yesterday mostly in and out 1400 lvl. Commodity mostly quiet today but fcpo took equity bullish tone. Sentiment improved after early attempt to break support lvl failed, snapping a 5-day losing streak.

Commodity mostly quiet today but fcpo took equity bullish tone. Sentiment improved after early attempt to break support lvl failed, snapping a 5-day losing streak.

This week...daily % change...fkli +ve everyday, fcpo -ve everyday..

This week...daily % change...fkli +ve everyday, fcpo -ve everyday..

Fbm produced another strong day – financials lead again. Strong week, strong closing – 6 day winning streak. Regional mostly weaker tone, within -1%. NK worst on prospect of stronger yen, affecting exporters bottom line. Europe/DJ futs cautious, initially recovery mode from overnight slump but dip back near flat line in late Asian trading hours.

Fbm produced another strong day – financials lead again. Strong week, strong closing – 6 day winning streak. Regional mostly weaker tone, within -1%. NK worst on prospect of stronger yen, affecting exporters bottom line. Europe/DJ futs cautious, initially recovery mode from overnight slump but dip back near flat line in late Asian trading hours.

Riding on fbm gains, fkli moves nearer to 1400 but cautious tone above 90 today. Regional mostly higher but losses steam in late trading hours. Europe.Dj futs flat to slightly minus.

Riding on fbm gains, fkli moves nearer to 1400 but cautious tone above 90 today. Regional mostly higher but losses steam in late trading hours. Europe.Dj futs flat to slightly minus.

Weakness all round. Fcpo hit high in PM opening with a 90-degree like climb from 2660 lvls but shortlived and hitting the low one hour later. Sell on rebound limited any chance of upside and lack of bargain yet. Tech weakness continued coupled with SO -1%

Weakness all round. Fcpo hit high in PM opening with a 90-degree like climb from 2660 lvls but shortlived and hitting the low one hour later. Sell on rebound limited any chance of upside and lack of bargain yet. Tech weakness continued coupled with SO -1%

With change-over of benchmark today, Fcpo missed fresh year high mark on continuous basis. Thats why sentiment so lousy ??

With change-over of benchmark today, Fcpo missed fresh year high mark on continuous basis. Thats why sentiment so lousy ??